Coastside Homeowners with Mortgage Distress – Don’t Wait!

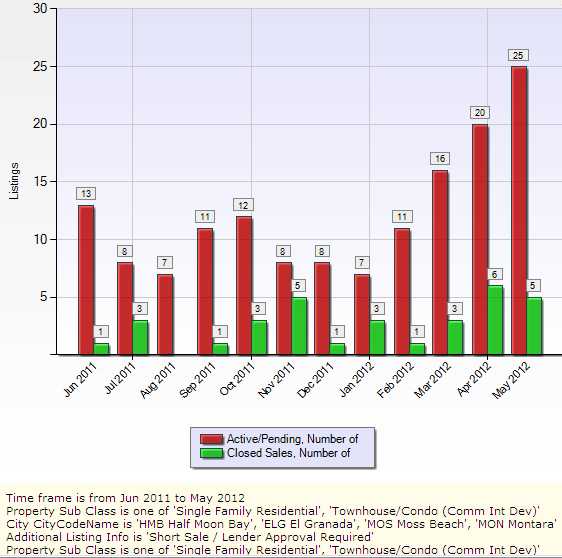

Short Sales listings on the Coastside have increased by about 100% over a year ago (chart below). I just completed a short sale listing with the guidance of colleague, Diana Plank. In going through this process with a C.D.P.E. designee, I learned a lot. Here’s what I’d like to share. First and foremost for anyone considering a short sale – Make the call before it’s too late! Call your Lender. Call your Realtor. Call your Attorney. Do not wait until you have received the Notice of Default to start exploring your options. You will know that something needs to be done even before you may have to stop making payments. Waiting will only cause you further distress and confusion.

Each Short Sale (situation) will be unique. Variables include:

• hardship

• number of loans

• who owns the loan

• who services the loan

• seller attitude

The major points I learned in the closing of my first short sale as a Listing Agent:

Timing – It is important for the seller to know that the lender is considering taking less money than what is owed them on the borrower signed loan, and in exchange there will be conditions to be met in addition to an acceptable price. Sellers will need to follow the timing of the short sale approval even if it is inconvenient.

Bank Process – The bank’s regulations require them to make phone calls, send notices, send duplicate notices and this can be confusing for the seller. The seller can give everything they receive to their Realtor to review, who will assess its importance in the process. It can be confusing for a seller to get documents that don’t seem consistent with what their Realtor is telling them. There is always a reason and your Realtor can explain.

Short Sale Approval Letter – Read it carefully with your professional advisers to understand the specific terms of the approval for the short sale. This includes every aspect of what is required and must be followed to the letter. Notice the names of buyers and sellers. They must match with the contract and may require matching with other documents such as the loan or trust.

Role of Escrow Officer – San Mateo County buyers have the opportunity to select the title and escrow company they use for their transaction, including short sale transactions. However, not all escrow officers are alike in their experience and business practices, just as not all Realtors are alike. Ensuring a smooth short sale demands excellent communication between the Realtors and Escrow. This is especially important because the Escrow Officer generates special statements for the short sale lender to approve (part of the approval letter) and they have to be generated within a specific time frame and last minute changes can be problematic.

Half Moon Bay to Montara – Number of SHORT SALE Homes & Condos

For Sale and Sold in the last 12 months

Graph Source: MLSListings, Inc.

Pacifica is a different market. Let me know if you want to see Pacifica short sale statistics if I don’t get them posted soon.

Sellers who may have underwater loans will also want to know that new rules went into effect June 1, 2012 which eases some guidelines for short sale approval. I expect this will enable more short sale listings to sell more quickly. For my listing, the short sale approval took 42 days and closed in 30 days from the approval. Both the first position buyer and the back-up buyer waited. Not bad.

This post is general information only and is NOT specific advice. If you are in mortgage distress, please contact your Realtor for professional advice for your situation.