Fed Funds Rate Cut – Where do we go from here?

As we begin to digest this week’s news of the half percent Fed Funds rate cut… Now what?

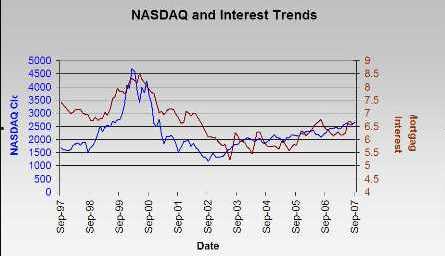

On Tuesday afternoon, when I asked my Manager, Robert Ross, what he thought of the Fed reducing the funds rate, he said, “it probably won’t affect our area too much.” Why, because we are San Mateo County, a bedroom community of tech-capital Silicon Valley, one of the wealthiest areas in the country. “Home sales are less affected by interest rate fluctuations here.” I won’t know the real reason without further analysis, but I would speculate that available assets to contribute to downpayments enables many of our buyers to obtain very good loan programs. The chart data, provided by Mortgage Consultants Ed Diaz and Jim Gallup shows the correlation between conforming interest rates and the NASDAQ. When local stocks are healthy more cash is available.

The Fed Funds rate (interest rate charges between banks) does not directly affect mortgage interest rates. It does affect home equity lines. The Fed’s interest rate cut will have the effect of diminishing fear and panic at the investor level, which will ease the liquidity, and cause larger amounts of money to begin flowing again soon. What does this mean for you as a home buyer or seller now?

Home sellers – You may get a few more buyers back in the market, more due to confidence than any additional money. The Freddie Mac or Fannie Mae conforming loans were never affected by our current mortgage situation; the jumbo loans will come back into the market once the the money flow has loosened a bit. Experts I have asked in the last few weeks say it should take until at least mid November before more jumbo products are available again.

Home buyers – Mortgage interest rates are tied to Bond market, not the Fed Funds rate. Also, lending standards have tightened since early August. Talk to your TRUSTED mortgage professional about your options. Each buyer’s situation is unique. Depending on where you are in the buying process and your timing, your mortgage professional will be able to explain what may be coming down the pike that you can prepare for following the Fed’s actions this week.

Sources and a couple articles of interest (tons of reading out there):

- Federal Reserve System website

- Gary Watts, Real Estate Economist (presentation on 9/20/07) – Email me for 8 page report

- Chicago Tribune, 9/21/07

- Business Week – “Vital Signs…” 9/20/07

- Jim Gallup, Mortgage Professional

- Ed Diaz, Mortgage Professional, P-Shift Mortgage Solutions

- Susan O’Driscoll, Mortgage Professional, Princeton Capital